How PACE could spur energy innovation along the Lakeshore

Bali Kumar explains how businesses and nonprofits can take advantage of the Michigan PACE program to finance sustainable building projects that often don't qualify for traditional bank loans.

One way to spur energy innovation along the Lakeshore is to take advantage of some of the options available to make buildings more sustainable. The hurdle usually isn’t a lack of interest but capital to pay for these upgrades. There’s a new financing tool that can make these kinds of green investments more affordable.

That’s where Bali Kumar can offer some advice. He is the CEO of the Detroit-based Lean & Green Michigan, the administrator of the Michigan PACE program. PACE stands for Property Assessed Clean Energy Act, a federal law that was adopted by Michigan in 2010. While 36 states have the program, how they structure them is different. Under the Michigan PACE Act, governmental units have to opt in to create a PACE district.

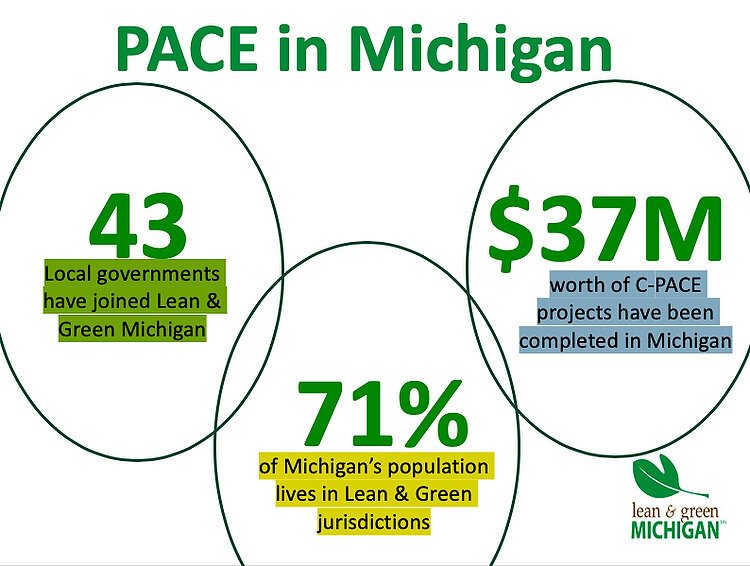

Currently, LAGM operates the PACE program in 44 local governments (26 counties and 18 cities/townships), but not yet in Muskegon, Ottawa or Allegan counties. On Jan. 28, Kumar spoke at the Sustainable Lakeshore Forum, at Grand Valley State University’s Robert B. Annis Water Resources Institute in Muskegon. He was invited to the monthly event sponsored by the West Michigan Sustainable Business Forum, to raise awareness about PACE and how it can spur innovation along the Lakeshore. Kumar recently answered our questions about the program.

The Lakeshore: What is PACE?

Bali Kumar: PACE is a long-term financing program through which a property owner has to put nothing down and they can use funds from energy and various other types of savings — through upgrades to their building that otherwise might not be financially viable — to pay off the loan. This is not a traditional bank loan, but a voluntary special assessment on the owner’s property tax. That’s helpful because PACE lenders are willing to give better terms. PACE offers a 25-year term for upgrading a building compared to a traditional bank’s seven-year term.

TL: Who qualifies?

BK: PACE in Michigan is only for commercial, industrial, multifamily, agricultural and nonprofit property owners. There isn’t a residential PACE program in Michigan. I usually refer homeowners to Michigan Saves if they are looking to add solar or other green improvements to their homes. Both programs are designed to make it easier for property owners to invest in making their buildings more sustainable, from energy efficiency and renewable energy to conserving water.

TL: What types of projects qualify for PACE financing?

BK: It is being used for new construction and for upgrading existing properties. It can also be used to refinance work already done. We worked with one property owner who spent $1 million out-of-pocket to make energy-efficiency upgrades to a building, including adding solar. He was actually able to get the money back and instead pay it over 20 years.

There is no upfront cost, which means people can put down nothing and then have the savings paid off over the life of the loan. PACE financing can be used for many projects, including a complete retrofit with new insulation, lighting, windows, and HVAC. A lot of folks are doing high-efficiency toilets and sinks. Some are doing using the program to install gray-water systems, solar, wind, geothermal and stormwater runoff, and to offset their stormwater charges. The last legislation change expanded the options to include installing EV charging stations. Basically, anything you can think of that is related to energy efficiency or water conservation could probably be financed by PACE with no out-of-pocket costs.

TL: How does the financing work?

BK: Five years ago, there was only one PACE lender focused on Michigan and most other PACE lenders were focused on California or New York or Florida. When there is only one lender, that lender can decide the interest rate. But now, we easily have 12-15 lenders, and you can make them compete on terms to give you the best terms. So that’s been helpful to the market. PACE financing requires you to perform sustainable upgrades to your property, but you can get financing around 6%.

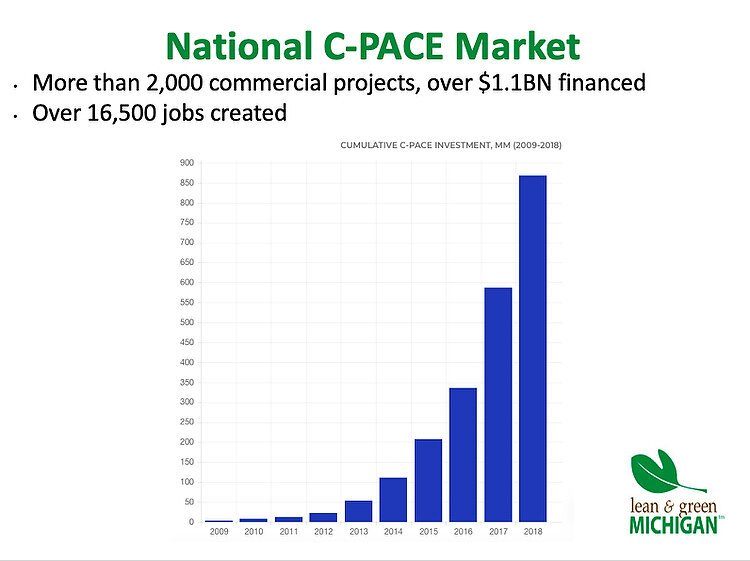

This is not tax increment financing. It’s paid for like a loan, but enforced like a tax. (Legally, PACE is a special assessment to a property tax.) The Michigan statute has a caveat that says that PACE doesn’t have to be repaid on the tax bill. They allow for direct payment from the property owner to the capital provider. If there is a failure to pay, then it would be enforced as a property tax. Note that we haven’t had the issue of non-payment in Michigan, and it hasn’t been an issue nationwide either, despite more than 2,000 PACE projects that have been completed nationwide.

TL: How can someone take advantage of PACE?

BK: PACE is an opt-in program. In Michigan, 44 local governments have opted in to our program, representing roughly 71% of the population. We’re adding additional counties and cities when property owners approach us, saying they want to access the financing. In Muskegon and Ottawa counties, some property owners have reached out and said, “Hey, we want a PACE district” but don’t have one in place yet.

People are also stacking PACE financing with other types of financing, such as historic tax credits and Brownfield TIFs. We tell people, if they’re gonna be looking at solar, they should be looking at the investment tax credit. There are a lot of ways to cobble financing together to help it make sense. PACE is becoming so much of a no-brainer that this is going to be a part of everybody’s thinking going forward. The process requires an energy analysis to show the benefit. For projects over $250,000, the savings generated by the project has to be greater than the investment in the project.

TL: What does your team do?

BK: Because PACE is a voluntary special assessment on the property tax, we do all the work on behalf of the local governments so they don’t have to hire someone to administer the program. We find the lenders. We do a lot of contractor training and provide it online so contractors understand how the financing works. We do a lot of one-on-one meetings with property owners, who are the decision-makers. We do marketing of the program, so people know it’s available. When the project is ready to be completed, we bring it all wrapped up to be authorized by the local government, so their involvement is limited. That way, we don’t waste governmental resources. We receive administration fees in connection with the closing of the financing. So if a property owner needs $500,000 in financing, they will take out slightly more to include our closing fees.

We offer PACE Express, an easier process, for projects less than $250,000. There’s no requirement that the savings has to be greater than the investment under PACE Express. This can be important for when a boiler breaks down in the winter and you need to replace it quickly. The Jackson County YMCA took advantage of the first PACE Express project in 2019. They took out $150,000 in furnace upgrades and boiler upgrades and LED lighting. They needed the money ASAP, and they got it done. There’s going to be significant savings, but they just didn’t want to have to go through the process and to calculate the savings/investment ratio.

TL: What’s LAGM’s track record?

BK: We’ve done 24 projects around the state, representing $37 million worth of financing. The smallest PACE project was a small apartment building for $117,600 and the biggest was $7 million into a new construction Cambria hotel in Detroit. For the latter, the PACE financing helped them complete their $49 million capital stack, which is all the money needed to finance the entire new construction of the hotel.

Nationally, the PACE is available to both commercial and residential properties. The PACE market has financed more than 2,000 projects nationwide with a combined value of over $1.1 billion. It’s a way for people to access capital. It’s a job creator – there’s a metric that shows that for every million dollars that PACE invests, 15 jobs are created. Nationally, more than 16,500 jobs have been created through the PACE market. So PACE is an economic development tool, a real estate finance tool, and a sustainability tool.

I had a developer tell me recently that he believed climate change is a hoax, but also how an energy-efficient building could save money and that’s all he cared about.

You can learn more about PACE at leanandgreenmi.com.

This article is part of The Lakeshore, a new featured section of Rapid Growth focused on West Michigan’s Lakeshore region. Over the coming months, Rapid Growth will be expanding to cover the complex challenges in this community by focusing on the organizations, projects, programs and individuals working to improve conditions and solve problems for their region. As the coverage continues, look for The Lakeshore publication, coming in 2020.